When it comes to choosing between a credit card and a debit card, there are a few key differences to consider. With a credit card, I can make purchases on credit, essentially borrowing money from the card issuer up to a certain limit. This can be handy for managing cash flow and building credit history, but it’s important to pay off the balance in full each month to avoid high interest charges.

A debit card is linked directly to my bank account, so when I use it to make a purchase, the funds are immediately deducted from my account. It’s a more straightforward way to spend, as I can only use what’s in my account, but there’s no credit involved, so it won’t help build a credit score.

Comparison Chart

| Parameter of Comparison | Credit Card | Debit Card |

|---|---|---|

| How it Works | Like borrowing money | Spends your own money |

| Source of Funds | Credit line from bank | Your checking account |

| Spending Limit | Set by bank (more than your paycheck) | Limited to what’s in your account |

| Payment | Pay back later (monthly statement) | Money comes out right away |

| Interest | Charged if not paid in full (ouch!) | No interest! |

| Rewards | Often offer cashback, points, or travel miles | Usually no rewards |

| Building Credit | Yes, with responsible use | No impact on credit score |

| Fraud Protection | Generally stronger protections | May have less protection |

What is Credit Card?

A credit card is a type of financial product that allows consumers to borrow money in order to make purchases. Credit cards are issued by financial institutions, and they come with a credit limit, which is the maximum amount of money that the cardholder can borrow. Credit cards also come with an interest rate, which is the rate of interest that the cardholder will be charged on any outstanding balance.

Credit cards can be used to make purchases at stores, online, or over the phone.

Using a credit card responsibly can help build your credit history and improve your credit score. Many credit cards offer rewards programs, such as cash back or points, which can be redeemed for travel, merchandise, or gift cards.

Key Features of Credit Cards

Credit Limit: Every credit card comes with a predetermined credit limit, which represents the maximum amount of money a cardholder can borrow. This limit is determined by various factors such as the cardholder’s credit history, income level, and overall creditworthiness. Exceeding the credit limit may result in penalties and additional fees.

Interest Rates: Credit cards charge interest on outstanding balances if the full amount is not paid by the due date. The interest rate, expressed as an annual percentage rate (APR), can vary depending on the card issuer and the type of card. Some credit cards offer promotional or introductory interest rates for a limited period, after which the standard rates apply.

Fees: Credit card issuers may impose various fees, including annual fees, late payment fees, over-limit fees, and foreign transaction fees. These fees can significantly impact the cost of using a credit card and should be carefully considered by cardholders when choosing a card.

Revolving Credit: One of the distinguishing features of credit cards is that they provide revolving credit, allowing cardholders to carry a balance from one month to the next. Unlike installment loans, where a fixed amount is repaid over a set period, credit card balances can fluctuate based on usage and payments made.

Benefits of Credit Cards

Convenience: Credit cards offer a convenient and secure method of payment, eliminating the need to carry large sums of cash. They are widely accepted by merchants worldwide, both in-store and online, making them an essential tool for everyday transactions.

Rewards and Incentives: Many credit cards offer rewards programs, where cardholders can earn cashback, points, or miles for every dollar spent. These rewards can be redeemed for various perks such as travel discounts, merchandise, or statement credits, providing additional value to cardholders.

Consumer Protection: Credit cards come with built-in consumer protection features, such as fraud monitoring, purchase protection, and extended warranties. In case of unauthorized transactions or disputes with merchants, cardholders have recourse to dispute the charges and seek resolution through their card issuer.

Building Credit History: Responsible use of credit cards can help individuals build a positive credit history, which is essential for obtaining loans, mortgages, and other financial products in the future. Timely payments and low credit utilization demonstrate creditworthiness and can improve credit scores over time.

Risks and Considerations

Debt Accumulation: One of the primary risks associated with credit cards is the potential for debt accumulation, especially if cardholders consistently carry a balance and incur high-interest charges. Overspending and failure to repay debts can lead to financial strain and negatively impact credit scores.

High-Interest Charges: Credit cards have high-interest rates compared to other forms of borrowing, making them costly for cardholders who carry balances from month to month. It’s essential for users to understand the terms and conditions of their cards and to pay off balances promptly to minimize interest charges.

Credit Score Impact: Mismanagement of credit cards, such as missing payments or maxing out credit limits, can damage credit scores and make it difficult to qualify for future loans or credit cards. Cardholders should strive to maintain a healthy credit utilization ratio and make timely payments to avoid negative repercussions on their credit history.

Fraud and Security: Credit card fraud is a prevalent concern in the digital age, with cybercriminals constantly devising new tactics to steal card information and commit fraudulent transactions. Cardholders should take precautions to safeguard their card details, such as using secure websites for online purchases and monitoring account activity for any unauthorized charges.

What is Debit Card?

Debit cards is a type of financial product that is linked directly to your bank account. This means that when you use your debit card to make a purchase, the funds are transferred directly from your account to the merchant. Debit cards can be used to withdraw cash from an ATM, or to make purchases anywhere that credit cards are accepted.

Debit cards offer a convenient way to access your money and can be used anywhere that credit cards are accepted. One of the main advantages of using a debit card is that you can avoid paying interest on your purchases, as you would with a credit card.

How Debit Cards Work

When a debit card is used for a transaction, the amount spent is immediately subtracted from the user’s checking account balance. This real-time deduction ensures that users can only spend the funds they have available, thus eliminating the risk of accruing debt. To initiate a transaction, the cardholder swipes, inserts, or taps their debit card at a point-of-sale terminal, enters their PIN (Personal Identification Number), or provides their signature, depending on the security measures implemented by the card issuer and merchant.

Types of Debit Cards

Debit cards can be categorized into different types based on their functionality and affiliations. The most common types include:

- Basic Debit Cards: These are standard debit cards issued by banks for everyday transactions, offering basic functionalities such as ATM withdrawals and in-store purchases.

- Prepaid Debit Cards: Prepaid debit cards are loaded with a specific amount of money by the cardholder and can be used until the balance is depleted. They are used by individuals who do not have traditional banking accounts or as gift cards.

- Affinity Debit Cards: Affinity debit cards are branded with the logo or image of a specific organization, such as a charity, sports team, or university. A portion of the transaction fees or purchases made with these cards may be donated to the affiliated organization.

- Rewards Debit Cards: Similar to rewards credit cards, rewards debit cards offer incentives such as cashback, points, or discounts on purchases made using the card. These rewards are based on the cardholder’s spending patterns and may vary among different issuers.

Benefits of Using Debit Cards

Debit cards offer several advantages for consumers:

- Convenience: Debit cards provide a convenient and secure way to make purchases without the need for cash or checks.

- Budgeting: Since debit card transactions are directly linked to the user’s checking account, they can help individuals track their spending and stick to a budget.

- No Interest Charges: Unlike credit cards, debit cards do not accrue interest charges since purchases are made using available funds.

- Widely Accepted: Debit cards are widely accepted by merchants and can be used for in-person and online transactions globally.

Risks and Considerations

While debit cards offer numerous benefits, they also come with certain risks and considerations:

- Fraud Protection: Debit card transactions may be less protected against fraud compared to credit cards. In case of unauthorized transactions, the liability for fraudulent charges may fall on the cardholder until reported.

- Overdraft Fees: If a debit card transaction exceeds the available balance in the linked checking account, the cardholder may incur overdraft fees or be declined for the transaction.

- Limited Purchase Protection: Debit cards may offer limited purchase protection and warranties compared to credit cards, which provide extended warranty coverage, purchase protection, and other consumer benefits.

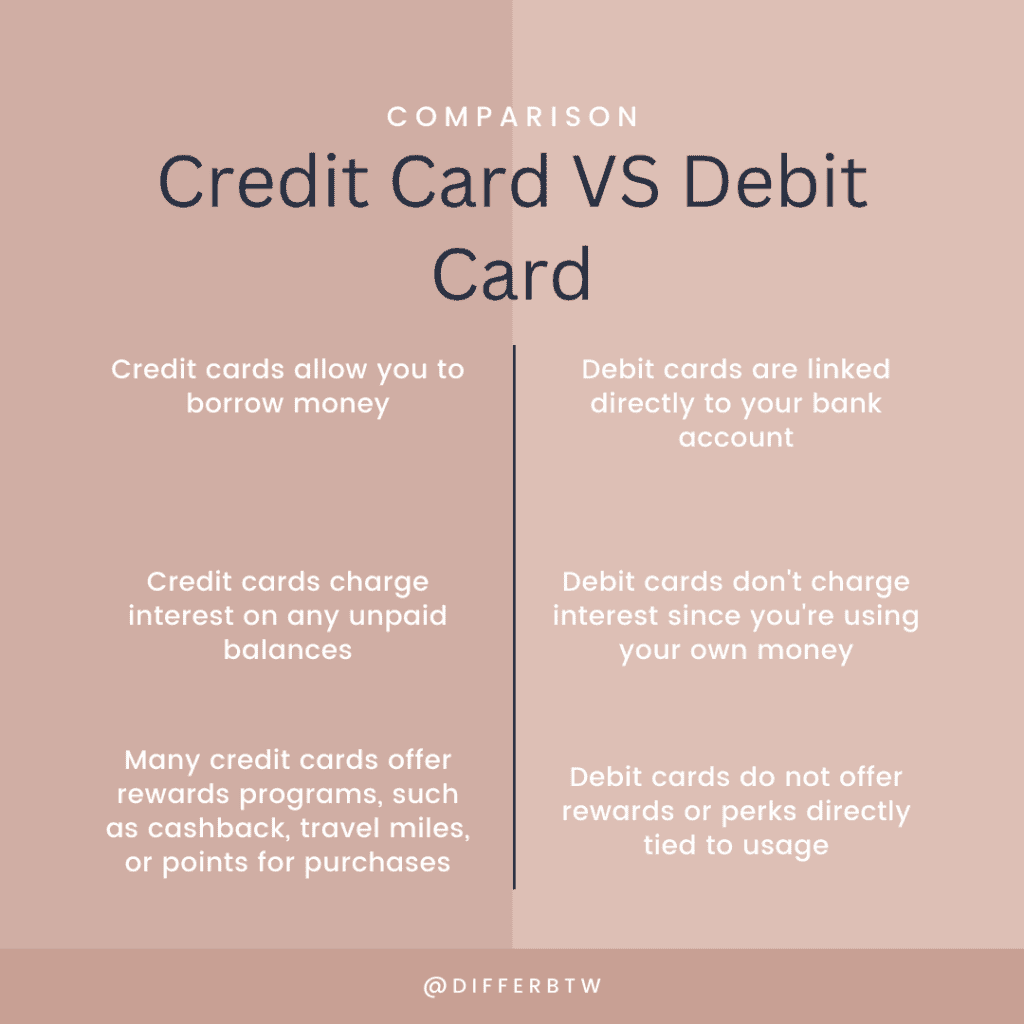

Difference Between Credit Card and Debit Card

Usage:

- Credit cards allow you to borrow money up to a certain limit to make purchases, which you then have to pay back with interest if not paid in full by the due date.

- Debit cards are linked directly to your bank account and use the funds available in that account to make purchases. You are not borrowing money but using your own funds.

Interest and Fees:

- Credit cards charge interest on any unpaid balances at the end of the billing cycle if you don’t pay the full amount. They may also have annual fees, late payment fees, and other charges.

- Debit cards don’t charge interest since you’re using your own money. However, some banks may have fees for overdrafts or for using ATMs outside of their network.

Spending Limit:

- Credit cards have a spending limit, which is the maximum amount you can borrow. This limit is determined by the credit card issuer based on factors like your credit history and income.

- Debit cards have a spending limit as well, but it’s the amount of funds available in your linked bank account.

Building Credit:

- Using a credit card responsibly by making timely payments can help build your credit score, which is important for getting loans, mortgages, and other credit products in the future.

- Debit card usage does not directly impact your credit score since you’re not borrowing money or repaying a loan.

Rewards and Perks:

- Many credit cards offer rewards programs, such as cashback, travel miles, or points for purchases. Some also come with perks like travel insurance, extended warranties, or purchase protection.

- Debit cards do not offer rewards or perks directly tied to usage, although some banks may have loyalty programs or cashback offers for specific purchases made with the card.

Emergency Use:

- Credit cards can be valuable in emergencies when you need to make a large purchase or cover unexpected expenses, as they provide access to a line of credit.

- Debit cards are also useful in emergencies for accessing funds in your bank account, but they are limited by the amount of money you have available in that account.