Assets are the resources we own that have value and can generate income, such as real estate, stocks, or savings accounts. These are investments that contribute to our wealth and financial stability over time. On the other hand, liabilities represent debts or obligations that we owe to others, such as mortgages, loans, or credit card balances.

Unlike assets, liabilities drain our resources by requiring us to make payments or repayments, with interest. It’s essential to strike a balance between accumulating assets to build wealth and managing liabilities to avoid excessive debt. By prioritizing assets over liabilities, we can work towards financial independence and security, gradually increasing our net worth over time.

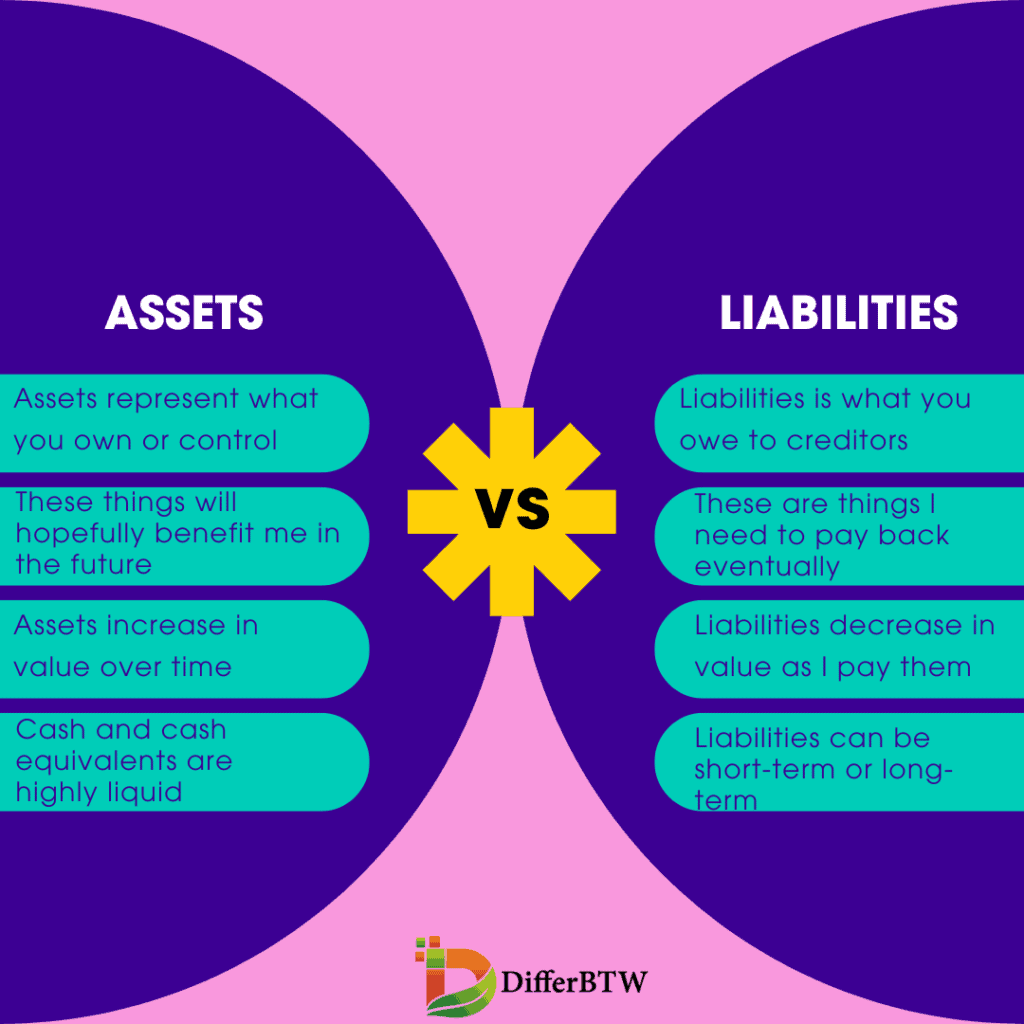

Comparison Chart

| Parameter of Comparison | Assets | Liabilities |

|---|---|---|

| What it is | Think of these as my valuable stuff. | These are my financial obligations, basically what I owe. |

| Example | My car, my savings account, that fancy watch I finally saved up for. | My credit card debt, student loans, that outstanding rent payment. |

| Future Benefit | These things will hopefully benefit me in the future. My car gets me places, my savings can be used for emergencies or goals, and the watch…well, it just looks cool! | Not exactly a benefit, but these are things I need to pay back eventually. |

| Impact on Value | Ideally, my assets increase in value over time. My car might be worth more if I take good care of it, and my savings account grows with interest. | Liabilities decrease in value as I pay them down. My credit card debt shrinks as I make payments. |

| Cash Flow | These guys can bring in cash! I could sell my car, withdraw money from savings, or even pawn the watch (not recommended!). | Liabilities are cash guzzlers. I gotta pay them off, which means money flows out of my pocket. |

What are Assets?

Assets are the things a company owns, have value and may be sold to generate cash, and are used in business operations. Assets can be classified in various ways such as in terms of liquidity, or in terms of whether they are tangible or not.

If it takes less than one year to convert an asset into cash, then it is known as a current asset, and cash is part of it. Examples of current assets are things like stocks, bonds, and property that can be sold in a short time for cash.

Those assets that take longer to be turned into cash and involve a lengthy process are referred to as long-term assets. You can take more than a year to sell a company vehicle or piece of land, for instance. Long-term assets that a company owns include land, buildings, vehicles, machinery, or tools.

Intangible assets are items that are not physical, but it would be hard to run a company without them. Examples of these items are patents, copyrights, trademarks, and goodwill.

Intellectual property is also an asset, and it is classified in the intangible category. Universities and research institutions are good examples of institutions or businesses that use intellectual property as assets to operate.

Importance and Purpose

Assets are essential for individuals, businesses, and organizations for several reasons:

1. Generating Income: Many assets can generate income streams either through direct use or by appreciation in value over time. For example, rental properties generate rental income, stocks provide dividends, and bonds pay interest.

2. Wealth Accumulation: Accumulating assets is a key strategy for building wealth and financial security. By investing in appreciating assets or those that generate income, individuals and businesses can grow their net worth over time.

3. Collateral for Financing: Assets can be used as collateral to secure loans or financing. Lenders require borrowers to pledge assets as security, reducing the risk associated with lending and providing borrowers with access to capital.

4. Diversification: Diversifying assets across different types and classes can help mitigate risk and protect against market fluctuations. By spreading investments across various assets, individuals and businesses can reduce exposure to the volatility of any single asset or market sector.

Valuation and Measurement

The value of assets can be determined through various valuation methods depending on the type of asset:

1. Market Value: Market value is the price at which an asset would trade in an open market between a willing buyer and a willing seller. Financial assets like stocks and bonds are valued based on market prices.

2. Cost Basis: For assets acquired through purchase, the cost basis represents the original purchase price plus any additional costs incurred to acquire and prepare the asset for its intended use.

3. Depreciation: Depreciation is the decrease in the value of physical assets over time due to wear and tear, obsolescence, or other factors. Depreciation expenses are recognized in financial statements to reflect the declining value of assets.

4. Amortization: Amortization applies to intangible assets and refers to the systematic allocation of their cost over their useful life. This process reflects the gradual consumption of the asset’s economic benefits over time.

Management and Optimization

Effective asset management involves strategies to maximize the value and performance of assets while minimizing risks and costs:

1. Asset Allocation: Asset allocation involves determining the optimal mix of asset classes (e.g., stocks, bonds, real estate) based on investment goals, risk tolerance, and time horizon.

2. Risk Management: Assessing and managing risks associated with different assets is crucial to preserving capital and achieving financial objectives. Strategies such as diversification, hedging, and insurance can help mitigate risks.

3. Monitoring and Evaluation: Regular monitoring and evaluation of asset performance are necessary to identify trends, opportunities, and potential risks. This allows for timely adjustments to asset allocation and investment strategies.

4. Asset Preservation: Proper maintenance and upkeep of physical assets are essential to preserving their value and prolonging their useful life. Regular inspections, repairs, and upgrades help prevent deterioration and ensure optimal performance.

Examples of Assets

- Cash: This is the most liquid asset and includes physical currency as well as funds in bank accounts that can be readily accessed for transactions.

- Real Estate: Properties such as land, buildings, and homes that can appreciate in value over time and generate rental income.

- Stocks: Ownership shares in publicly traded companies, representing a claim on the company’s assets and earnings.

- Bonds: Debt securities issued by governments or corporations, providing fixed interest payments over a specified period and returning the principal amount upon maturity.

- Vehicles: Automobiles, trucks, and other vehicles owned by individuals or businesses, which can be used for transportation or as assets to be sold for cash.

What are Liabilities?

Liabilities are debts or obligations of a company that have not been paid yet. Most businesses run by borrowing or acquiring items from vendors on credit. they have to pay salaries and wages, and it is not possible to do this in advance.

There are current liabilities which are short-term obligations that become due within the next 12 months. They include items such as accounts payable, accruals, and short-term debt.

Long-term liabilities are obligations that get paid any time after the first 12 months. They include items such as long-term debt and deferred taxes. An example of long-term debt includes borrowing money to buy an extra bus because a school has had an increase in student population.

We can say that liabilities are a necessary evil in the running of a business. They are, in many cases, unavoidable, by the very nature of how big companies run. They help businesses expand and thus get more profits.

When liabilities are higher than assets, it is a sign that the business is likely to be unable to meet its obligations to creditors. No one wants to lend their money to potentially bad creditors, and financial institutions are no different.

Types of Liabilities

Current Liabilities: These are obligations that are expected to be settled within the normal operating cycle of the business, within one year. Examples include accounts payable, short-term loans, accrued expenses, and current portions of long-term debt. Current liabilities are important indicators of a company’s short-term liquidity.

Long-Term Liabilities: Long-term liabilities are debts or obligations that are due beyond one year from the date of the balance sheet. These may include long-term loans, bonds payable, pension obligations, and lease liabilities. Understanding long-term liabilities is essential for evaluating a company’s ability to manage its long-term financial commitments.

Contingent Liabilities: Contingent liabilities are potential obligations that may arise from past events but their existence depends on the occurrence of future events. Examples include warranties, pending lawsuits, and guarantees. While contingent liabilities may not require immediate payment, they can have a significant impact on a company’s financial health if they materialize.

Deferred Liabilities: Deferred liabilities, also known as deferred revenues or deferred income, arise when a company receives payment from customers for goods or services that have not yet been delivered or earned. These liabilities represent an obligation to fulfill the promised goods or services in the future.

Importance of Liabilities

Financial Health Assessment: Liabilities provide crucial insights into a company’s financial health and its ability to meet its obligations. By analyzing the composition and magnitude of liabilities, investors and creditors can gauge the risk associated with investing in or lending to a company.

Risk Management: Managing liabilities effectively is essential for mitigating financial risk. Companies must balance their use of debt to fund operations or expansion with their ability to repay creditors. Excessive liabilities can strain cash flows and increase the risk of default.

Strategic Decision Making: Understanding liabilities influences strategic decision-making processes such as financing options, capital structure management, and investment prioritization. By optimizing the mix of debt and equity financing, companies can lower their cost of capital and maximize shareholder value.

Regulatory Compliance: Proper reporting and disclosure of liabilities are required by accounting standards and regulatory authorities. Failure to accurately account for and disclose liabilities can result in legal and financial consequences, including fines, penalties, and loss of investor trust.

Examples of Liabilities

- Loans: Borrowed funds from banks or financial institutions that must be repaid with interest over a specified period, such as mortgages, car loans, or personal loans.

- Credit Card Debt: Outstanding balances on credit cards used to make purchases, which accrue interest if not paid off in full each month.

- Mortgages: Long-term loans used to purchase real estate, where the property itself serves as collateral for the loan.

- Accounts Payable: Money owed by a company to its suppliers or vendors for goods or services purchased on credit.

- Bonds Payable: Debt obligations issued by a company or government entity to investors, entitling bondholders to receive periodic interest payments and the repayment of the principal amount at maturity.

Difference Between Assets and Liabilities

Assets:

- Ownership: Assets represent what you own or control. They can range from tangible items like real estate, equipment, and inventory to intangible items like patents, copyrights, and trademarks. Essentially, assets are resources that have value and can generate future benefits.

- Value: Assets have economic value and can be converted into cash. They are listed on the balance sheet at their historical cost less any accumulated depreciation or impairment, although certain assets like marketable securities may be recorded at fair value.

- Growth Potential: Some assets have the potential to appreciate over time, generating additional wealth for the owner. For example, investments in stocks or real estate may increase in value, providing a return on investment.

- Risk: While assets can appreciate, they also come with risks. The value of assets can fluctuate due to changes in market conditions, economic factors, or other external influences. For instance, the value of stocks can be volatile, and real estate prices may fluctuate based on supply and demand dynamics.

- Utility: Assets provide utility or serve a purpose for the owner. For instance, a piece of machinery can be used to manufacture products, while a patent can protect intellectual property rights.

- Liquidity: Assets vary in their liquidity, or how quickly they can be converted into cash without significantly impacting their value. Cash and cash equivalents are highly liquid, while real estate may take longer to sell.

Liabilities:

- Obligation: Liabilities represent what you owe to creditors or other entities. They can include loans, mortgages, accounts payable, and accrued expenses. Essentially, liabilities are obligations that must be settled in the future through the transfer of assets or the provision of services.

- Cost: Liabilities arise from past transactions or events, where there has been an outflow of resources or an obligation to transfer resources in the future. They are recorded on the balance sheet at their outstanding balance, which represents the amount owed at a given point in time.

- Interest: Many liabilities come with interest obligations, which represent the cost of borrowing money. For example, a company may issue bonds with a stated interest rate, requiring periodic interest payments to bondholders.

- Risk: Liabilities introduce financial risk because they represent obligations that must be met regardless of the company’s financial performance. Failure to meet these obligations can lead to penalties, legal actions, or damage to the company’s reputation.

- Impact on Cash Flow: Liabilities can impact cash flow by requiring future cash outflows to settle obligations. For instance, loan payments reduce available cash and may limit the company’s ability to invest in growth opportunities.

- Term: Liabilities can be short-term or long-term. Short-term liabilities, such as accounts payable, are due within one year, while long-term liabilities, such as mortgages or bonds payable, have maturities beyond one year.