A Letter of Credit (LC) is like a financial safety net in the business world. It’s a promise from a bank that if you can’t pay, they’ve got your back. It’s handy for international deals, ensuring that both parties feel secure in the transaction. On the other hand, a Bank Guarantee is a bit like vouching for your friend in the financial realm.

If you can’t meet your obligations, the bank steps up to cover your back, acting as a financial guardian angel. Both are trust-building tools, giving businesses the confidence to dive into deals without losing sleep over uncertainties.

Comparison Chart

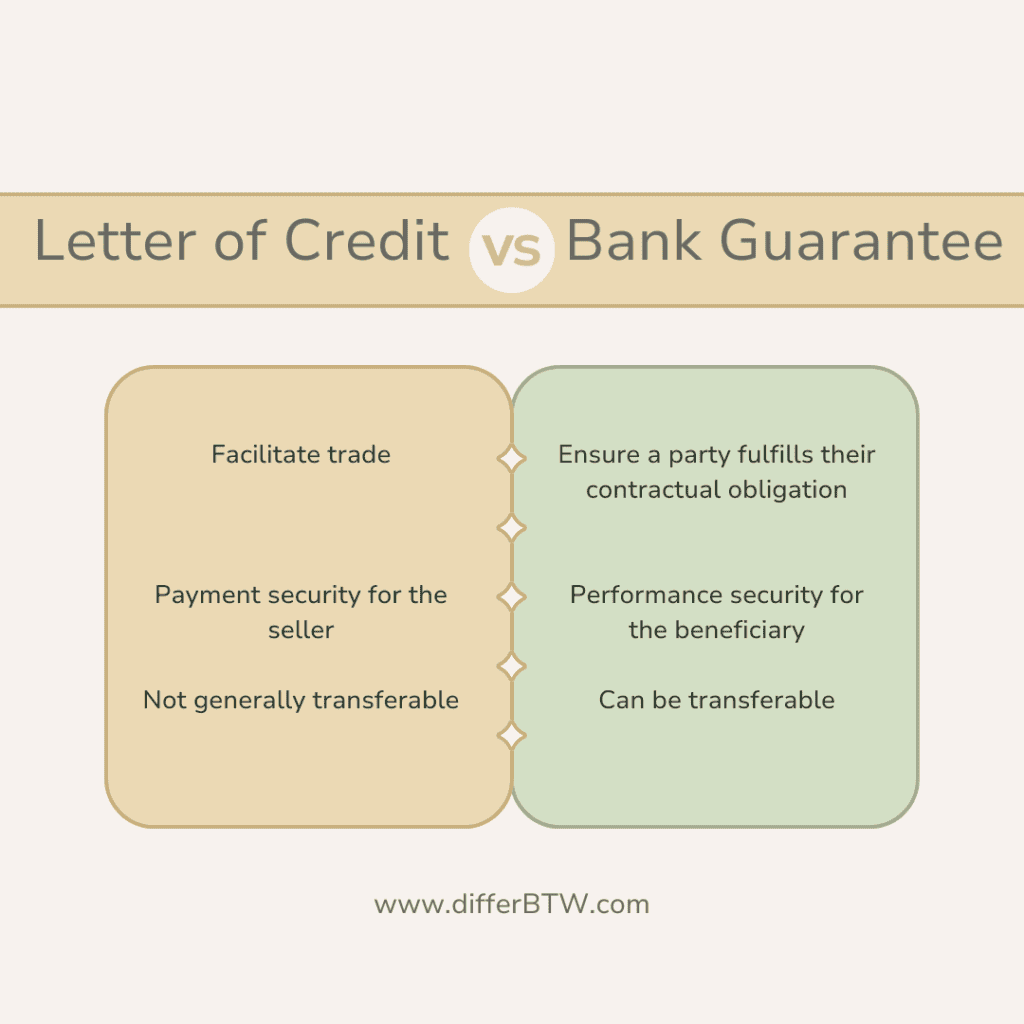

| Parameter of Comparison | Letter of Credit (LC) | Bank Guarantee (BG) |

|---|---|---|

| Primary Purpose | Facilitate trade, especially international, by guaranteeing payment to the seller upon fulfilling agreed-upon conditions. | Ensure a party fulfills their contractual obligations in a transaction, financial or performance-based. |

| Parties Involved | * Issuing Bank (buyer’s bank) * Applicant (buyer) * Beneficiary (seller) * Advising Bank (seller’s bank) (Optional) | * Issuing Bank * Applicant (party requesting guarantee) * Beneficiary (party receiving guarantee) |

| Payment Trigger | Payment is made only if the seller presents documents that strictly comply with the LC terms (e.g., bill of lading, commercial invoice). | Payment is made if the applicant fails to meet their contractual obligations as stipulated in the BG (e.g., delivering goods on time, meeting quality standards). |

| Focus | Payment security for the seller. | Performance security for the beneficiary. |

| Common Use Cases | International trade, import/export transactions. | Construction projects, rental agreements, advance payments, tender bids. |

| Types | * Documentary LC (payment based on documents) * Standby LC (payment upon buyer’s default) * Usance LC (payment after a specific period) | * Performance Guarantee (ensures completion of agreed-upon tasks) * Financial Guarantee (covers financial obligations like payment) |

| Cost | Issuing bank charges fees to the applicant based on the LC amount and type. | Issuing bank charges fees to the applicant based on the BG amount and risk involved. |

| Dispute Resolution | Disputes are settled based on the LC documents and terms, through independent inspections. | Disputes are settled based on the contract terms and evidence of non-performance. |

| Transferability | Not transferable. | Can be transferable depending on the specific BG type. |

Similarities Between Letter of Credit and Bank Guarantee

Risk Mitigation

Both Letters of Credit and Bank Guarantees serve as risk mitigation tools in international trade and various business transactions. They provide assurance to the parties involved that their interests are protected, reducing the risk of non-payment or non-performance.

Bank Involvement

In both cases, a bank plays a crucial role. The bank issues the Letter of Credit on behalf of the buyer or provides the Bank Guarantee to support the buyer’s obligations. The involvement of a reputable financial institution enhances the credibility of the arrangement.

Contractual Nature

Both instruments are essentially contractual agreements between the parties involved and the issuing bank. The terms and conditions outlined in the LC or BG must be carefully defined and agreed upon to ensure clarity and avoid disputes.

What is Letter of Credit?

A finance agreement is a document given by a bank or financial institution. This payment is to a vendor for goods or services that a client has agreed to acquire. The letter of credit assures the seller that they will be paid even if the buyer does not.

If the buyer fails to make a payment, the seller will be paid by the bank or financial institution that issued the letter of credit. In international commerce operations, letters of credit are frequently utilized.

A letter of credit is a written assurance by a bank that it will pay the holder of the letter a specified sum of money upon the presentation of documents that meet the letter’s requirements.

A commercial invoice, a bill of lading, and an insurance policy are necessary. The letter of credit substitutes the bank’s creditworthiness for the buyer’s.

Types of Letters of Credit

There are various types of Letters of Credit, each designed to cater to specific needs and situations:

- Commercial Letter of Credit: This is the most common type and is utilized for the purchase and sale of goods. The issuing bank assures the seller of payment upon the fulfillment of contractual obligations.

- Standby Letter of Credit (SBLC): Unlike commercial L/Cs, SBLCs serve as a secondary payment mechanism in case the buyer fails to fulfill their obligations. It acts as a guarantee of payment to the seller.

- Revocable and Irrevocable Letters of Credit: Revocable L/Cs can be modified or canceled by the issuing bank without notice, while irrevocable L/Cs cannot be altered or canceled without the agreement of all parties involved.

Key Participants

Several parties play crucial roles in a Letter of Credit transaction:

- Applicant: The buyer who initiates the letter and requests the issuing bank to issue the L/C.

- Beneficiary: The seller or exporter who will receive payment once the conditions stipulated in the L/C are met.

- Issuing Bank: The bank that opens the L/C on behalf of the buyer, undertaking the responsibility of payment upon fulfillment of the terms.

- Advising Bank: An intermediary bank, located in the seller’s country, that advises and confirms the L/C to the beneficiary.

- Confirming Bank: In cases of confirmed L/Cs, this bank adds its confirmation to the issuing bank’s credit, providing an additional layer of assurance to the beneficiary.

Process Flow

The L/C process involves several steps:

- Application: The buyer submits a request to the issuing bank to open an L/C, providing necessary documentation.

- Issuance: The issuing bank verifies the buyer’s creditworthiness and, upon approval, issues the L/C to the beneficiary.

- Advising and Confirmation: The advising bank informs the beneficiary of the L/C, and in some cases, a confirming bank adds its confirmation.

- Shipment and Documents: The seller ships the goods and presents the required documents to the nominated bank, which may be the advising or confirming bank.

- Payment: Upon compliance with the terms of the L/C, the nominated bank releases payment to the beneficiary.

Advantages and Risks

Advantages:

- Risk Mitigation: L/Cs provide security by ensuring that the seller will receive payment upon meeting contractual obligations.

- International Trade Facilitation: Enables smoother cross-border transactions by instilling confidence in both buyers and sellers.

Risks:

- Complexity: The process can be intricate, involving multiple parties and extensive documentation.

- Costs: L/Cs may incur fees, and discrepancies in documents can lead to additional charges.

What is Bank Guarantee?

The financial backup plan protects in the event of loan failure. if the borrower is unable to repay the obligation. The lender may seek payment from the bank that granted the guarantee.

This fund provides loans for significant purchases such as real estate or automobiles. Other sorts of debt, such as credit card debt, can also be covered by bank guarantees.

This fund provides loans for significant purchases such as real estate or automobiles. Other sorts of debt, such as credit card debt, can also be covered by bank guarantees.

A bank guarantee is a formal promise made by a bank on behalf of its customer to make payments to a third party up to a certain amount if the consumer fails to do so. A bank guarantee’s goal is to give security to a third party and limit the risk of loss.

Types of Bank Guarantees

1. Performance Guarantee

A Performance Guarantee ensures that the applicant will meet the terms of a contract. If the applicant fails to fulfill their contractual obligations, the beneficiary can claim the guaranteed amount.

2. Bid Bond

Issued during the bidding process for a project, a Bid Bond guarantees that the winning bidder will undertake the project under the terms of their bid. If the bidder fails to do so, the bond is encashed.

3. Advance Payment Guarantee

This type of guarantee is issued when a customer receives an advance payment. It assures the payer that the advance will be refunded if the terms of the agreement are not met.

4. Financial Guarantee

Financial Guarantees are used in financial transactions, such as loans or credit arrangements. They provide assurance to the lender that the borrower will meet their financial obligations.

Issuance Process

1. Application

The applicant initiates the process by submitting a request to the issuing bank. The application includes details such as the type and amount of guarantee, purpose, and supporting documentation.

2. Credit Evaluation

The bank assesses the creditworthiness of the applicant before deciding whether to issue the guarantee. This involves evaluating the financial standing and reputation of the applicant.

3. Issuance

Upon approval, the bank issues the Bank Guarantee document, outlining the terms, conditions, and the guaranteed amount. The beneficiary is provided a copy of the guarantee.

Key Parties Involved

1. Applicant

The party requesting the Bank Guarantee is known as the applicant. This could be an individual, company, or organization seeking to secure a business transaction.

2. Beneficiary

The beneficiary is the party in favor of whom the Bank Guarantee is issued. In the event of the applicant’s default, the beneficiary can claim the guaranteed amount.

3. Issuing Bank

The bank that issues the Bank Guarantee is the issuing bank. It undertakes the responsibility to pay the beneficiary if the applicant fails to fulfill their obligations.

4. Advising Bank

In international transactions, an advising bank may be involved to convey the guarantee to the beneficiary. While not obligated to pay, the advising bank authenticates the guarantee.

Risks and Considerations

1. Financial Risk

There is a financial risk for the issuing bank if they have to honor the guarantee. Therefore, thorough credit evaluation of the applicant is crucial to mitigate this risk.

2. Documentation Accuracy

Any discrepancies or inaccuracies in the issued guarantee may lead to disputes. Clear and precise documentation is essential to avoid misunderstandings.

3. Expiration and Renewal

Bank Guarantees have a specified validity period. It is important for both the applicant and the beneficiary to be aware of the expiration date and make necessary arrangements for renewal if required.

Difference Between Letter of Credit and Bank Guarantee

Letter of Credit (LC):

- Nature:

- LC is a financial document issued by a bank on behalf of a buyer, guaranteeing payment to the seller upon the presentation of specified documents.

- Purpose:

- Mainly used in international trade to ensure that the seller receives payment as long as they comply with the terms and conditions set in the LC.

- Involvement of Parties:

- Involves three parties – the buyer, the seller, and the issuing bank.

- Payment Guarantee:

- The issuing bank assures the seller that the payment will be made, provided the seller meets the terms and conditions outlined in the LC.

- Types:

- Common types include Revocable and Irrevocable LCs, with the latter being more widely used as it cannot be amended or canceled without the consent of all parties.

- Flexibility:

- LCs can be transferable or non-transferable, giving flexibility in terms of transferring payment obligations.

Bank Guarantee (BG):

- Nature:

- BG is a guarantee provided by a bank on behalf of a buyer to the seller, assuring that the buyer will fulfill their financial obligations.

- Purpose:

- Used to secure transactions, contracts, or agreements, ensuring that the buyer fulfills their obligations, such as payment or performance.

- Involvement of Parties:

- Involves three parties – the applicant (buyer), the beneficiary (seller), and the issuing bank.

- Payment Guarantee:

- The issuing bank promises to pay a specific amount to the beneficiary if the buyer fails to fulfill the agreed-upon obligations.

- Types:

- BGs can be categorized into various types, including Bid Bond, Performance Bond, Financial Guarantee, and Advance Payment Guarantee, each serving different purposes.

- Flexibility:

- Generally less flexible than LCs as they are specific to the terms of the underlying contract or agreement.

- Use in Contracts:

- Often used in construction and large-scale projects to guarantee performance or payment.