An audit and a review are like cousins in the financial scrutiny family. During an audit, it’s like the financial investigator puts on a detective hat, digging deep to unveil all the hidden financial secrets. Every nook and cranny is inspected, and the goal is to provide a solid thumbs-up or down on the financial health.

On the flip side, a review is more like a casual check-up with the family doctor.It’s not as intense as an audit, more like a quick peek under the hood to make sure everything seems in order. So, audits are the thorough detectives, while reviews are the friendly neighborhood doctors of the financial world.

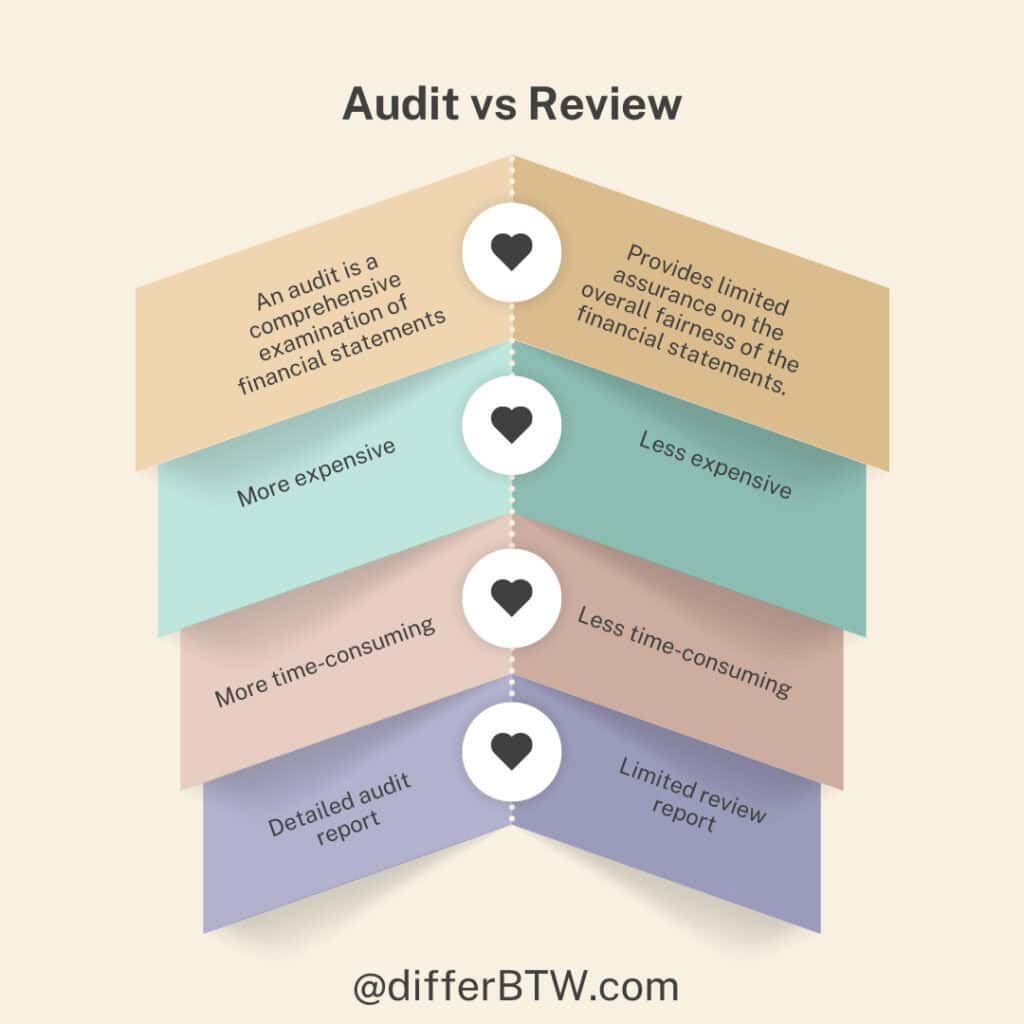

Comparison Chart

| Parameter of Comparison | Audit | Review |

|---|---|---|

| Level of Assurance | High | Moderate |

| Purpose | Provides an independent opinion on whether the financial statements are free from material misstatement. | Provides limited assurance on the overall fairness of the financial statements. |

| Procedures | Extensive testing of accounting records, internal controls, and analytical procedures. | Analytical procedures and inquiries of management. |

| Expertise Required | Requires a qualified and independent auditor (CPA) to follow Generally Accepted Auditing Standards (GAAS). | Can be conducted by an accountant or CPA, but not necessarily subject to the same level of rigor as an audit. |

| Cost | More expensive due to the in-depth nature of the work. | Less expensive due to fewer procedures performed. |

| Time Required | More time-consuming due to the comprehensive testing involved. | Less time-consuming compared to an audit. |

| Report Issued | Detailed audit report expressing an opinion on the fairness of the financial statements. | Limited review report providing limited assurance on the financial statements. |

| Suitability | Publicly traded companies, companies with significant debt financing, companies with complex financial structures. | Smaller companies, companies with limited stakeholders, companies seeking basic comfort on their financial statements. |

| Regulation | May be mandatory for certain companies by law or by lenders/investors. | Usually not mandatory, but can be requested by stakeholders for additional assurance. |

What is Audit?

Audit is a spoken word in the field of accounting and finance. Conceptually, it refers to the impartial analysis of an entity’s transactions and records. Auditing is a critical component of the finance structure of large-sized enterprises.

Auditing ensures that the transactions and financial operations conducted within a company during a certain period of time are fair and legitimate. It carefully examines each and every financial activity and checks for its authenticity and validity.

Mainly there are two forms of audit: internal audit and external audit. External audits are conducted to ensure the fairness of transactions, whereas internal audits serve as a managerial process to improve processes and performance. At times, both types are simultaneously involved.

Audits are done by a professional auditor. He can either be an individual in a regular position in a firm or a person hired by the company. In the latter case, there is the possibility of a more transparent audit. Business experts consider Audit the key to success in any industry.

Types of Audits

1. Financial Audit:

Financial audits focus on the examination of an organization’s financial statements and related transactions. The auditor assesses whether the financial information is presented fairly, in accordance with accounting principles and regulatory requirements.

2. Operational Audit:

Operational audits evaluate the efficiency and effectiveness of an organization’s internal processes, systems, and procedures. The goal is to identify areas for improvement in operational performance and risk management.

3. Compliance Audit:

A compliance audit ensures that an entity adheres to relevant laws, regulations, and internal policies. This type of audit helps organizations avoid legal issues and maintain ethical standards.

4. Information Systems Audit:

Information systems audits assess the security, integrity, and availability of an organization’s information technology infrastructure. This includes evaluating controls over data, software, and hardware.

Audit Process

1. Planning:

The audit process begins with careful planning. This phase involves understanding the entity’s operations, identifying key risks, and developing an audit strategy. The auditor establishes objectives, timelines, and resource requirements.

2. Risk Assessment:

Risk assessment involves evaluating potential risks that may impact the accuracy of financial information or the efficiency of operations. Auditors use this information to determine the nature, timing, and extent of audit procedures.

3. Fieldwork:

During the fieldwork phase, auditors collect and examine evidence through various procedures. This includes testing transactions, confirming balances with third parties, and conducting physical inspections.

4. Reporting:

Upon completion of fieldwork, the auditor prepares a report summarizing their findings. The report includes an opinion on the fairness of the financial statements, highlighting any significant issues or areas of concern.

Auditor’s Responsibilities

1. Independence:

Auditors must maintain independence to ensure objectivity and impartiality in their assessments. Independence is a fundamental principle that enhances the credibility of the audit process.

2. Professional Skepticism:

Auditors apply professional skepticism by critically assessing evidence and challenging assumptions. This mindset helps uncover potential misstatements or irregularities.

3. Confidentiality:

Auditors are bound by confidentiality, ensuring that sensitive information obtained during the audit process is not disclosed without proper authorization.

4. Continuous Professional Development:

To stay current with industry developments and regulations, auditors engage in continuous professional development. This ensures their skills and knowledge remain relevant.

What is Review?

Review in financial management is a crucial process to evaluate different financial factors, e.g., errors in transactions, financial deviations, budget variations, and financial grievances. A review specifically checks that the allocated budget is successfully utilized.

A financial reviewer performs his duty once a month in any organization. He is responsible for identifying, correcting, and reporting errors in financial matters of the organization. He is entitled to reach out to the concerned individual/department for a quick resolution.

There is an array of things that are done in a financial review. For example, in Personnel Expenses, it is checked that the payroll is working in compliance with the rules and policies of the organization. It also checked whether transactions were in line with the budget policy or not.

Reviews are limited in their scope and objectives. Reviewers are affordable and can be hired by small-sized businesses as well. Moreover, it does not take an enormous amount of time to prepare and present a financial review report.

In the realm of finance, a review encompasses a comprehensive examination and assessment of financial activities, statements, and performance of an individual, business, or investment portfolio. The primary objective is to gain insights into the financial health, stability, and efficiency of the subject under scrutiny.

Importance of Financial Reviews

Financial reviews play a pivotal role in decision-making processes, providing stakeholders with a clearer understanding of the current financial standing and future prospects. This process aids in identifying strengths, weaknesses, opportunities, and threats, facilitating strategic planning and risk management.

Components of Financial Review

- Financial Statements Analysis: The cornerstone of any financial review involves a meticulous analysis of financial statements, including the balance sheet, income statement, and cash flow statement. This analysis helps in evaluating liquidity, profitability, and solvency.

- Performance Metrics: Assessing various financial ratios and performance metrics is crucial. Return on investment (ROI), return on equity (ROE), and debt-to-equity ratio are examples of metrics that shed light on the efficiency and risk profile of the entity.

- Market Trends and Economic Factors: A comprehensive financial review extends beyond internal factors to consider external influences. Analyzing market trends, economic indicators, and industry benchmarks aids in contextualizing financial performance.

Conducting a Financial Review

- Data Collection: Gathering accurate and up-to-date financial data is the initial step. This includes financial statements, transaction records, and relevant documentation.

- Ratio Analysis: Applying various financial ratios helps in quantifying different aspects of performance. Liquidity ratios, such as the current ratio, gauge short-term solvency, while profitability ratios assess the efficiency of operations.

- Risk Assessment: Identifying and evaluating financial risks is integral. This involves assessing market risks, credit risks, and operational risks to ascertain the potential impact on financial stability.

Reporting and Recommendations

Upon completion of the financial review, a detailed report is generated, outlining findings, insights, and recommendations. This report is presented to stakeholders, guiding them in making informed decisions about investments, financial strategies, or organizational improvements.

Continuous Improvement

A financial review is not a one-time event; it should be a recurring process. Regular reviews allow for the monitoring of financial performance over time, enabling timely adjustments to strategies and ensuring adaptability to changing economic conditions.

Difference Between Audit and Review

Audit:

- Nature:

- An audit is a comprehensive examination of financial statements, internal controls, and accounting processes.

- It involves a thorough investigation to express an opinion on the fairness of the financial statements.

- Objective:

- The primary goal of an audit is to provide reasonable assurance that the financial statements are free from material misstatements and present a true and fair view.

- Scope:

- The scope of an audit is broader, covering not only financial statements but also internal controls and compliance with accounting standards.

- Independence:

- Auditors must maintain independence to ensure unbiased and objective assessments of financial information.

- Evidence:

- Auditors gather extensive evidence through testing transactions, examining documentation, and performing substantive procedures.

- Reporting:

- The auditor issues an audit report expressing an opinion on the financial statements, highlighting any material misstatements.

- Legal Requirements:

- Audits are required by law for certain entities, such as public companies, to provide transparency and protect stakeholders’ interests.

Review:

- Nature:

- A review is a less extensive examination of financial statements compared to an audit.

- It involves inquiries and analytical procedures but doesn’t include the same level of detail as an audit.

- Objective:

- The goal of a review is to provide limited assurance that the financial statements are free from material misstatements.

- Scope:

- The scope of a review is narrower, focusing mainly on analytical procedures and inquiries to identify any significant issues.

- Independence:

- While independence is still important, the requirements are less strict for a review compared to an audit.

- Evidence:

- Reviews involve less detailed testing and documentation compared to audits, relying more on analytical procedures and inquiries.

- Reporting:

- The accountant issues a review report expressing limited assurance on the financial statements but does not provide an opinion.

- Legal Requirements:

- Reviews may be sufficient for private companies that are not subject to strict regulatory requirements, offering a cost-effective alternative to a full audit.