Difference Between EFT and NEFT EFT is a broader term that encompasses any transfer of funds through electronic means, including NEFT, RTGS, and IMPS. On the other hand, NEFT is …

All That Difference Between

All That Difference Between

Difference Between EFT and NEFT EFT is a broader term that encompasses any transfer of funds through electronic means, including NEFT, RTGS, and IMPS. On the other hand, NEFT is …

Difference Between Credit Report and FICO A credit report is a detailed summary of your credit history, including your payment behavior, the amount of debt you have, and the length …

Difference Between ACH and eCheck ACH (Automated Clearing House) is a network that facilitates electronic payments and transfers between banks, used for direct deposits, bill payments, and business-to-business transactions. On …

Difference Between Commercial Bank and Private Bank Commercial banks cater to the general public and businesses, offering a wide range of services such as savings accounts, loans, and credit facilities. …

Difference Between Commercial Bank and Development Bank Commercial banks focus on providing short-term loans, accepting deposits, and offering various financial services like savings accounts and credit cards to individuals and …

Difference Between Commercial Bank and Non-Commercial Bank Commercial banks are financial institutions that provide services like accepting deposits, offering loans, and facilitating transactions for individuals and businesses. Their primary goal …

Difference Between Commercial Bank and Cooperative Bank Commercial banks are profit-driven institutions owned by shareholders, offering a wide range of financial services like savings accounts, loans, and credit cards, with …

What is Electronic Fund Transfer (EFT)? Electronic Fund Transfer (EFT) refers to the electronic transfer of money from one bank account to another, either within a single financial institution or …

What is EFT? Electronic Funds Transfer, commonly referred to as EFT, is the electronic exchange of money between accounts using computer-based systems. It enables individuals and businesses to conduct financial …

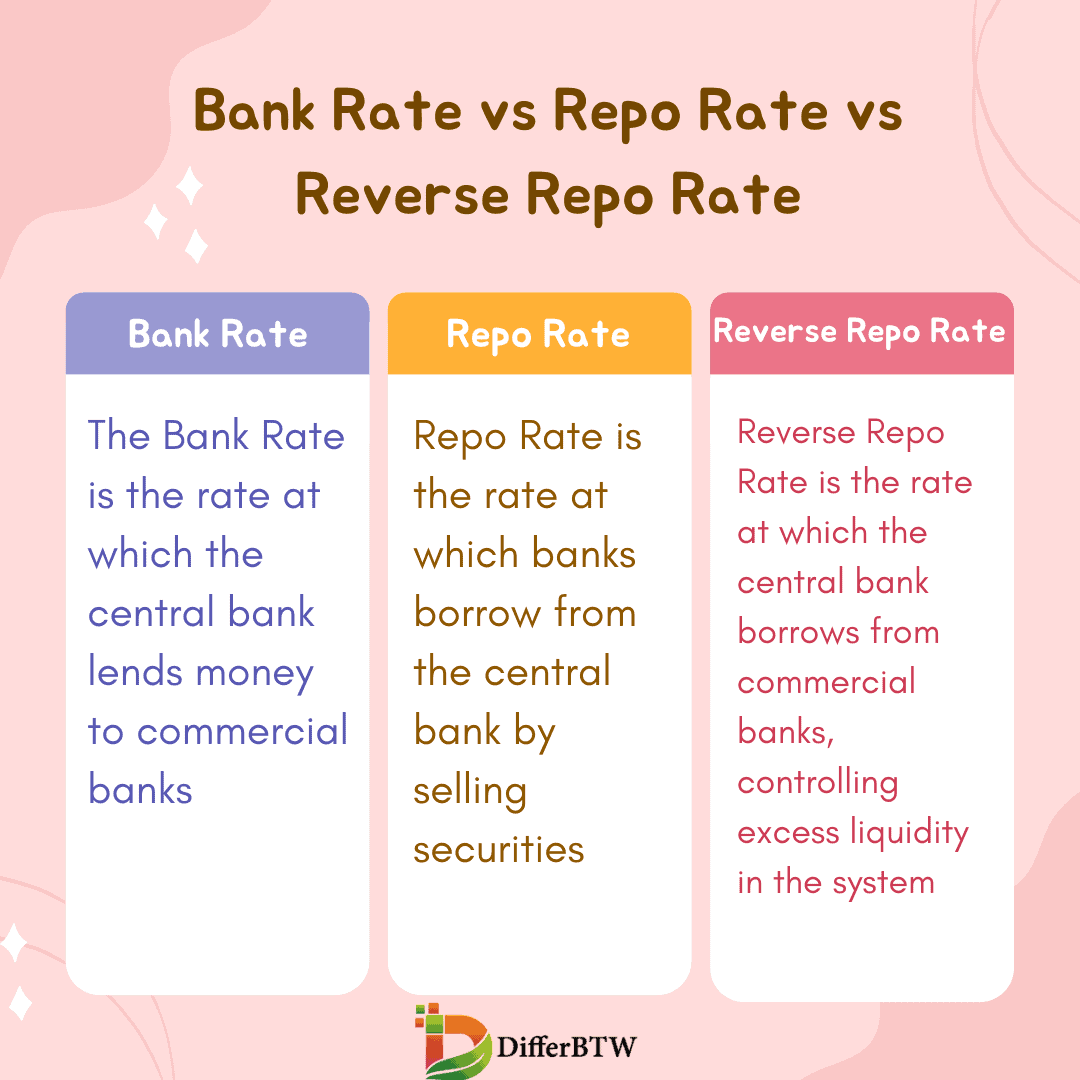

Bank Rate, Repo Rate, and Reverse Repo Rate are key interest rates that influence the economy. The Bank Rate is the rate at which the central bank lends money to …

What is a Merchant Bank? A merchant bank is a financial organization that provides a variety of services, including underwriting, issuing securities, and merger and acquisition advice to big businesses …

What is Core Banking? Core banking is an abbreviation of centralized online real-time environment banking. It is a back-end system in which banking transactions, financial records, and other updates regarding …

What is Commercial Bank? Commercial banks are financial institutions that provide a wide range of services to businesses, governments, and individuals. They are the primary source of financial services in …

What is Commercial Bank? A commercial bank is a financial institution that provides banking services to businesses, companies, and individuals. Commercial banks are financial intermediaries, meaning they accept deposits from …

What is Bank Guarantee? A bank guarantee is a security from a bank that it will make good on a customer’s debt if it cannot do so. It is a …