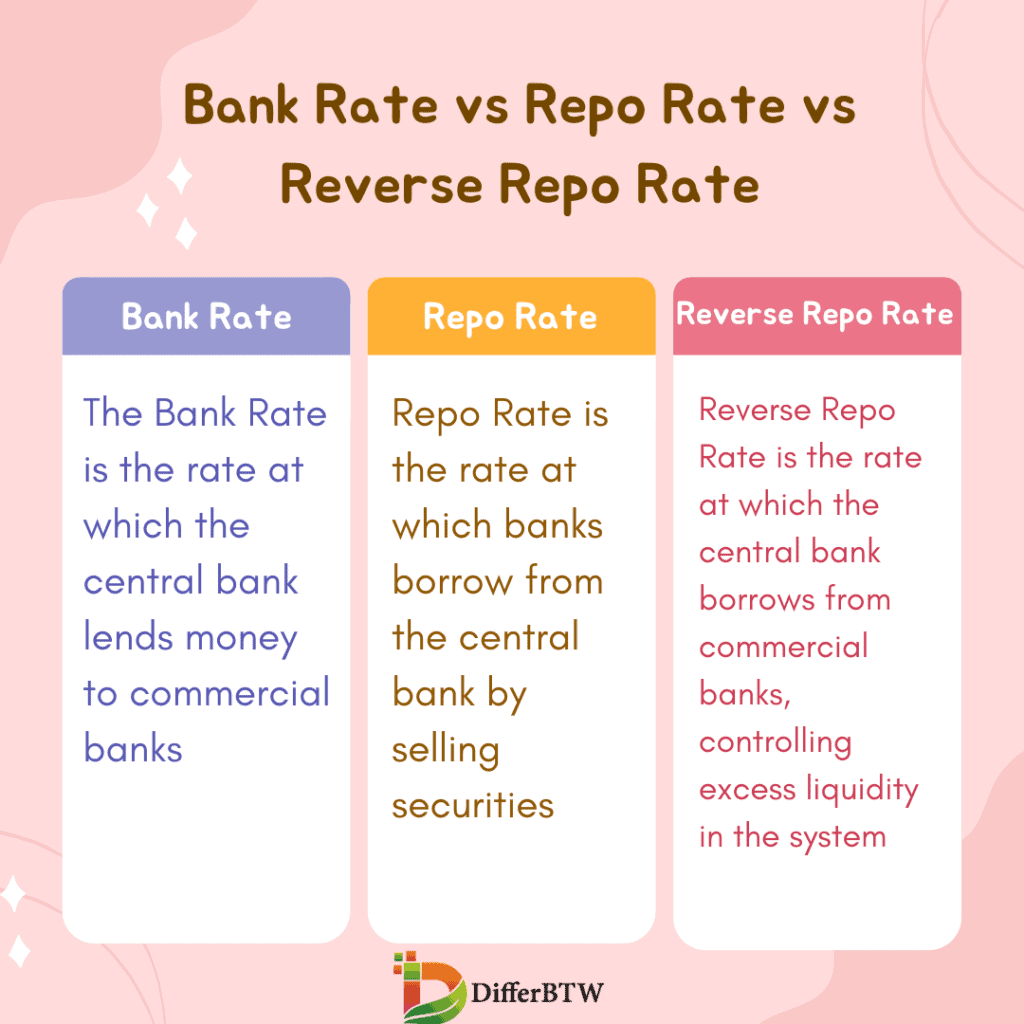

Bank Rate, Repo Rate, and Reverse Repo Rate are key interest rates that influence the economy. The Bank Rate is the rate at which the central bank lends money to commercial banks, setting the tone for overall interest rates. On the other hand, Repo Rate is the rate at which banks borrow from the central bank by selling securities, impacting short-term borrowing costs.

Reverse Repo Rate is the rate at which the central bank borrows from commercial banks, controlling excess liquidity in the system. These rates play a crucial role in shaping borrowing and lending dynamics, impacting everything from loans to savings.

Difference Between Bank Rate and Repo Rate and Reverse Repo Rate

- Definition:

- Bank Rate: It is the interest rate at which a country’s central bank lends money to commercial banks. It serves as a benchmark for other interest rates in the economy.

- Repo Rate: Also known as the repurchase rate, it is the interest rate at which the central bank lends money to commercial banks against government securities.

- Reverse Repo Rate: This is the interest rate at which the central bank borrows money from commercial banks.

- Purpose:

- Bank Rate: It influences the overall interest rate levels and helps control money supply and inflation in the economy.

- Repo Rate: It is a tool for the central bank to manage short-term liquidity in the market and control inflation.

- Reverse Repo Rate: It is used by the central bank to absorb excess liquidity from the market.

- Nature:

- Bank Rate: It is a long-term policy instrument that is relatively stable.

- Repo Rate: It is a short-term instrument and can be adjusted more frequently to address immediate economic conditions.

- Reverse Repo Rate: Like the repo rate, it is a short-term tool used for liquidity management.

- Borrower and Lender:

- Bank Rate: Commercial banks borrow from the central bank at this rate.

- Repo Rate: Commercial banks borrow from the central bank at this rate by providing government securities as collateral.

- Reverse Repo Rate: Commercial banks lend to the central bank at this rate by providing cash, with government securities as collateral.

- Effect on Economy:

- Bank Rate: It has a broader impact on interest rates, investment, and economic growth.

- Repo Rate: It directly affects short-term interest rates, influencing borrowing costs for banks and, consequently, for businesses and consumers.

- Reverse Repo Rate: It helps in managing excess liquidity and controlling inflationary pressures.

- Risk Factor:

- Bank Rate: Relatively low risk for the central bank.

- Repo Rate: Moderate risk as it involves collateral in the form of government securities.

- Reverse Repo Rate: Low risk as it involves lending to the central bank with government securities as collateral.

- Role in Monetary Policy:

- Bank Rate: It is a tool for influencing long-term interest rates and overall economic activity.

- Repo Rate: It is a key tool for short-term monetary policy, influencing liquidity in the financial system.

- Reverse Repo Rate: It helps in managing short-term liquidity and signaling the central bank’s stance on monetary policy.

- Frequency of Adjustment:

- Bank Rate: Adjusted relatively infrequently, reflecting long-term policy changes.

- Repo Rate: Can be adjusted more frequently, reflecting short-term changes in economic conditions.

- Reverse Repo Rate: Adjusted based on the central bank’s liquidity management needs.

- Market Impact:

- Bank Rate: It has a more indirect impact on market interest rates.

- Repo Rate: It directly influences short-term market interest rates.

- Reverse Repo Rate: It can influence short-term rates and market liquidity.

Comparison Table

| Parameter of Comparison | Bank Rate | Repo Rate | Reverse Repo Rate |

|---|---|---|---|

| Definition | Interest rate at which the central bank lends short-term funds (for a few days) to commercial banks | Rate at which the central bank repurchases government securities from commercial banks in a repurchase agreement (repo) | Rate at which the central bank absorbs short-term surplus liquidity from commercial banks by selling government securities |

| Set by | Central Bank (e.g., RBI in India, Federal Reserve in the US) | Central Bank | Central Bank |

| Impact on Banks | Increases borrowing cost for banks | Tightens money supply by reducing liquidity with banks, potentially leading to higher interest rates on loans they offer | Loosens money supply by injecting liquidity into banks, potentially leading to lower interest rates on loans they offer |

| Impact on Borrowers | Increases borrowing cost for borrowers (individuals and businesses) as banks pass on the higher borrowing cost | Increases borrowing cost for borrowers (individuals and businesses) due to tighter money supply and potentially higher bank lending rates | Reduces borrowing cost for borrowers (individuals and businesses) due to looser money supply and potentially lower bank lending rates |

| Impact on Economy | Used as a broad-based tool to influence overall credit availability and economic activity | Primarily targets short-term liquidity in the banking system to manage inflation and interest rates | Primarily targets short-term liquidity in the banking system to manage inflation and interest rates |

| Frequency of Change | Changed less frequently than repo rate | Changed more frequently than bank rate to manage short-term liquidity fluctuations | Changed less frequently than repo rate but can be used to signal future changes in monetary policy |

| Relation to Repo Rate | Generally higher than repo rate | Usually the benchmark rate for other short-term interest rates in the economy. Repo rate can be higher than bank rate in unusual circumstances | Lower than repo rate to incentivize banks to deposit surplus funds with the central bank |

What is Bank Rate?

The Bank Rate is a key monetary policy tool utilized by central banks to influence the overall economic conditions within a country. Also known as the discount rate or policy rate, it serves as a crucial determinant of interest rates in the financial system. Central banks use the Bank Rate to regulate borrowing costs, control inflation, and manage economic stability.

Setting the Bank Rate

1. Monetary Policy Implications

The central bank’s Monetary Policy Committee (MPC) is responsible for setting the Bank Rate. This decision is influenced by various factors, including inflation targets, economic growth, and employment levels. By adjusting the Bank Rate, central banks aim to achieve their monetary policy objectives.

2. Inflation Control

One primary objective of manipulating the Bank Rate is to control inflation. If inflation is above the target, the central bank might raise the Bank Rate to increase the cost of borrowing, thereby reducing spending and cooling off the economy.

3. Economic Stimulus

Conversely, during economic downturns, the central bank may lower the Bank Rate to encourage borrowing and spending. This helps stimulate economic activity, as lower interest rates make borrowing more attractive for businesses and consumers.

Impact on Financial Markets

1. Interest Rates Across the Board

Changes in the Bank Rate have a ripple effect on interest rates throughout the financial system. Commercial banks adjust their prime lending rates in response to alterations in the Bank Rate, influencing the rates consumers and businesses encounter when seeking loans.

2. Foreign Exchange Rates

The Bank Rate can also impact a country’s exchange rates. Higher interest rates may attract foreign capital, leading to an appreciation of the national currency. Conversely, lower rates may result in a depreciation as investors seek higher returns elsewhere.

Role in Banking Operations

1. Discount Window Operations

Commercial banks can borrow funds directly from the central bank through the discount window at the Bank Rate. This provides a mechanism for banks to manage short-term liquidity needs and meet regulatory reserve requirements.

2. Liquidity Management

The Bank Rate influences overall liquidity in the financial system. Changes in the rate can impact the availability of credit, affecting the liquidity conditions for banks and financial institutions.

What is Repo Rate?

Repo rate, short for repurchase rate, is a key monetary policy tool employed by central banks to regulate the money supply in the financial system. This interest rate determines the cost at which commercial banks can borrow money from the central bank by pledging government securities as collateral. The repo rate plays a crucial role in influencing overall economic activity, inflation, and liquidity in the financial markets.

Mechanism and Operation

When a commercial bank requires funds, it can enter into a repurchase agreement (repo) with the central bank. In this arrangement, the bank sells government securities to the central bank with an agreement to repurchase them at a later date, within a short period. The repo rate is the interest rate charged by the central bank for providing this short-term liquidity to commercial banks. The higher the repo rate, the more expensive it is for banks to borrow funds, and vice versa.

Monetary Policy Implementation

Central banks use changes in the repo rate as a tool to implement monetary policy. An increase in the repo rate makes borrowing more expensive for banks, leading to reduced money supply and potentially curbing inflation. Conversely, a decrease in the repo rate aims to stimulate economic activity by making borrowing more affordable, encouraging spending and investment.

Impact on Financial Markets

The repo rate has a cascading effect on various financial markets. Changes in the repo rate influence interest rates across the banking system, affecting lending and borrowing rates for businesses and consumers. Moreover, shifts in the repo rate can impact bond yields, equity prices, and currency exchange rates, making it a critical factor for investors and financial market participants to monitor.

Relationship with Other Interest Rates

The repo rate is closely linked to other interest rates in the economy. For example, an increase in the repo rate leads to higher lending rates for businesses and consumers, which can have implications for consumption, investment, and economic growth. Central banks carefully consider these interconnections when adjusting the repo rate to achieve their monetary policy objectives.

Challenges and Criticisms

While the repo rate is a powerful tool, its effectiveness may be influenced by various factors, including global economic conditions, financial market volatility, and the overall health of the banking sector. Critics argue that relying solely on the repo rate may not always address broader economic challenges and that a combination of monetary and fiscal measures is essential for comprehensive policy implementation.

What is Reverse Repo Rate?

The Reverse Repo Rate is a crucial monetary policy tool employed by central banks, including the Reserve Bank of India (RBI) and the Federal Reserve. This rate plays a pivotal role in regulating the money supply and controlling inflation within an economy.

Definition and Mechanism

The Reverse Repo Rate is the interest rate at which the central bank borrows money from commercial banks for a short-term period, overnight. In this transaction, commercial banks park excess funds with the central bank in exchange for government securities. The central bank, in turn, pays interest to the banks, making it an attractive option for them to invest their surplus funds.

Objectives of Reverse Repo Rate

Liquidity Management

One primary objective of implementing the Reverse Repo Rate is to manage liquidity in the financial system. By offering an attractive interest rate on the funds parked by commercial banks, the central bank can influence the flow of money in the market.

Interest Rate Signal

The Reverse Repo Rate also serves as an important signal to the market regarding the central bank’s stance on monetary policy. When the central bank increases the reverse repo rate, it encourages banks to park more funds with it, signaling a contractionary monetary policy stance aimed at curbing inflation.

Impact on the Economy

Controlling Inflation

The Reverse Repo Rate indirectly affects inflation by influencing the overall money supply in the economy. When the central bank raises this rate, it encourages banks to lend less and deposit more funds with it, reducing the money available for lending in the market. This contractionary effect helps in controlling inflation.

Cost of Borrowing

Commercial banks use the reverse repo facility as a safe and low-risk investment option. Consequently, an increase in the Reverse Repo Rate may lead to higher borrowing costs for the banks, affecting their lending rates to customers. This, in turn, can impact consumer spending and investment in the economy.

Criticisms and Limitations

Impact on Credit Growth

One criticism of relying heavily on the Reverse Repo Rate is its potential to hamper credit growth. The increased attractiveness of parking funds with the central bank may discourage banks from extending credit to businesses and individuals, slowing down economic activity.

Market Distortions

Overemphasis on the Reverse Repo Rate may lead to distortions in the money market, as it influences short-term interest rates significantly. Central banks need to strike a balance to ensure that the rate aligns with broader economic objectives without causing disruptions in the financial markets.