When it comes to transferring money electronically, I weigh the pros and cons of using Electronic Funds Transfer (EFT) versus Automated Clearing House (ACH). EFT involves transferring funds between bank accounts within the same financial institution, offering speedy transactions ideal for immediate payments like bill settlements.

On the other hand, ACH transactions allow me to transfer funds between different banks, but they may take a bit longer to process, within a couple of business days.

Comparison Chart

| Parameter of Comparison | EFT (Electronic Funds Transfer) | ACH (Automated Clearing House) |

|---|---|---|

| Type | Broad term for electronic payments | Specific type of EFT |

| Examples | ACH transfers, debit card purchases (PIN transactions), wire transfers, ATM withdrawals | Direct deposit, direct payments (e-checks) |

| Network | Varies depending on the specific EFT type | ACH network in the US |

| Speed | Varies – can be real-time (wire transfers) or take several days (ACH) | Usually 1-3 business days |

| Cost | Varies – cheaper than credit cards | Typically lower fees than other EFTs |

| Security | Secure, but security features may vary depending on the type of EFT | Considered a secure payment method |

| Best for | Versatile – suitable for various transactions | Recurring payments, large transfers (depending on limits) |

What is EFT?

EFT is the electronic transfer of funds from one account to another. either within the same financial institution or across institutions, using computer-based technologies.

EFTs are suitable for a variety of payments. They are deposits of salary, social security benefits, tax refunds, and online bill payments. EFTs are more efficient for several people than writing and mailing paper checks.

EFT is a form of digital payment that enables customers. It is used to transfer money between banks without using cash. The Monetary Authority facilitates EFT payments, which can be done via ACH, electronic transfers, or digital wallets.

How It Works

The technique involves gently tapping with fingertips on certain points of the body, located on the face, upper body, and hands. These points correspond to the endpoints of meridians, which are pathways through which energy flows according to traditional Chinese medicine. By tapping on these points, it is believed that the flow of energy can be corrected, leading to emotional relief and physical healing.

Personal Experience

I first encountered EFT during a period of intense stress and anxiety. Skeptical at first, I decided to give it a try after hearing positive reviews from friends. To my surprise, I found that tapping along with guided EFT sessions provided a sense of calm and clarity that I hadn’t experienced before. It felt like a weight had been lifted off my shoulders, and I could approach challenges with a newfound sense of resilience.

Applications and Benefits

EFT has been used to address a wide range of issues, including anxiety, depression, phobias, trauma, and even physical pain. Many practitioners believe that it can help release negative emotions stored in the body, leading to long-lasting emotional healing. Some studies have shown promising results in reducing symptoms of PTSD and anxiety, although more research is needed to fully understand its efficacy.

Integrating EFT into Daily Life

One of the great things about EFT is its accessibility. It can be practiced almost anywhere and at any time, making it a valuable tool for managing stress in daily life. Whether it’s tapping during a stressful work meeting or using it to calm pre-exam jitters, EFT can be a powerful ally in promoting emotional well-being.

What is ACH?

An ACH is a digital payment that is executed via an automated clearinghouse network.

ACH payments are widely used for one-time or periodic payments. They are used for utilities, mortgage loans, and other bills, as well as direct deposit of salaries, benefits from social security, and tax returns.

ACH is increasingly widespread for individual payments. It is less expensive than other payment methods or wired government subsidies.

An ACH payment is a kind of electronic payment that occurs through the ACH network. The ACH network is a global system for confirming and collecting bank transactions.

Benefits of ACH

ACH offers several advantages over traditional payment methods like paper checks. One of the biggest benefits is speed. Unlike checks, which can take days to clear, ACH transactions settle within one to two business days, making them a faster and more efficient way to move money. ACH payments are more secure than checks since they’re electronic and less susceptible to fraud or theft. Another advantage is cost-effectiveness. ACH transactions are cheaper than processing paper checks, saving businesses money on printing, postage, and processing fees.

Personal Experience with ACH

I’ve personally found ACH to be incredibly convenient for managing my finances. Whether it’s setting up recurring bill payments or receiving direct deposits from my employer, ACH makes it easy to automate financial transactions and streamline my budgeting process. I appreciate the reliability and efficiency of ACH payments, knowing that my money will be transferred quickly and securely without the hassle of dealing with paper checks.

Difference Between EFT and ACH

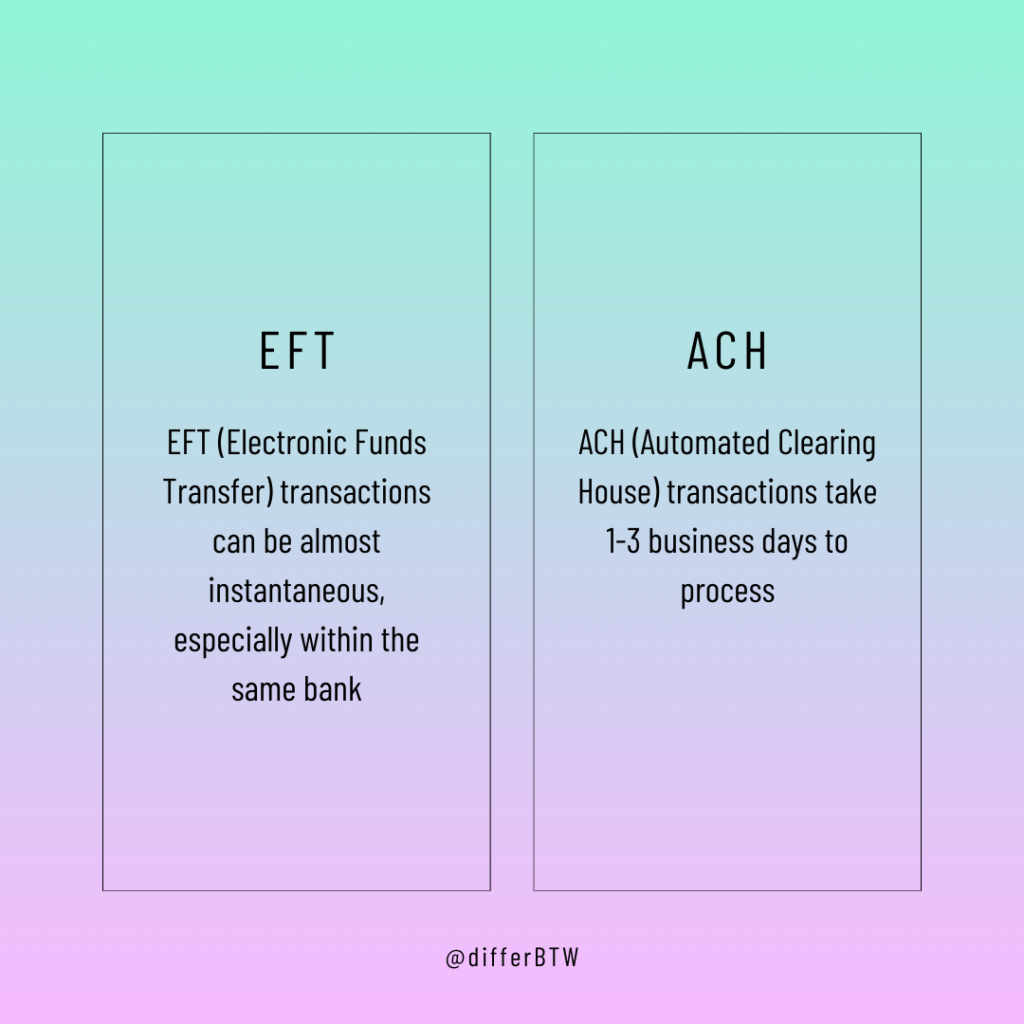

- Speed: ACH (Automated Clearing House) transactions take 1-3 business days to process, whereas EFT (Electronic Funds Transfer) transactions can be almost instantaneous, especially within the same bank.

- Cost: ACH transactions are cheaper, with fees ranging from a few cents to a few dollars per transaction, while EFT transactions might incur higher fees, especially for international transfers or expedited processing.

- Accessibility: ACH transactions are widely used for payroll, bill payments, and direct deposits, making them more accessible for businesses and individuals. EFT transactions are used for large transfers between financial institutions or for online purchases.

- Security: Both ACH and EFT transactions are considered secure, but ACH transactions may have slightly more risk due to the longer processing times, which could allow for more opportunities for fraud or unauthorized transactions.

- Regulation: ACH transactions are governed by the National Automated Clearing House Association (NACHA) rules, ensuring standardized practices and dispute resolution procedures. EFT transactions may be subject to different regulations depending on the countries involved, which can affect processing times and fees.

- International Transfers: ACH transactions are primarily used for domestic transfers within the United States, while EFT transactions are more used for international transfers due to their ability to handle different currencies and banking systems.

- Ease of Use: ACH transactions are integrated into banking platforms and software, making them easy to initiate and track. EFT transactions may require more manual intervention, especially for large or complex transfers.

- Reliability: Both ACH and EFT transactions are reliable, but ACH transactions may be subject to occasional delays or processing errors due to the volume of transactions processed by clearing houses.

- Personal Preference: In my experience, ACH transactions are preferable for recurring payments like rent or utility bills, where the reliability and lower cost are advantageous. However, for urgent transfers or international transactions, EFT provides a faster and more versatile option.